Heavy Chandeliers

root causes of stagnation in crypto + an ethos for the future

My thanks to Kelvin Fichter, Mark Tyneway, Derek Hsue, Mene Mazarakis, Luke van Seters and Liam Horne for discussions. Mistakes are my own.

In the depths of the ‘22 crisis, David of Bankless broke into tears.

“We have these..awesome foundations.. [But] they just keep enabling the worst, it gets harder to justify what the hell we’re doing here man… Scammers can leverage them better… We’re running out of ways to explain it to normies..”

Since then Bitcoin and Ethereum are up ~50%.

Stunning incompetence at US regional banks have provided the latest crypto bull narrative. The fools that managed these traditional institutions deserve the mockery they are receiving. The deposit structure of these banks was knowable. The mark to market losses on treasuries was knowable. To anybody who knew a little bond math and could think independently, the outcome was foreseeable.1

But for those of us who want to build alternative crypto institutions to replace declining incumbents, mockery is not enough. We must have the humility and integrity to draw lessons from our own most painful moments. We must do so before they disappear from memory amidst the giddy arrogance of the next bull run.

Others have written about account abstraction, CEXes vs DEXes, smart contracts vs humans at the center. Likewise the recent progress at the infrastructural layer has been well covered. I have no interest in beating a dead horse.

I want to focus on what David articulated in the depths of his despair and many have thought in private. I want to focus on root causes.

Why are there so many scammers in crypto and why do so many manage to succeed?

Why do so many useless, unoriginal, needlessly complex protocols get built when so much important original work is waiting to be done?

What is the path forward for our industry?

10ft Nails

History can provide us the psychological distance to see the problem more clearly.

Half a century ago, at the height of Soviet prestige, central planners in Moscow grappled with the problem of how to measure and incentivize rapid progress.

Weight quickly emerged as an imperfect but practical measure of industrial output. A steel mill’s performance can be measured by the tons of steel it produces. Target tons of output, incentivize factories to achieve the targets and the economy will grow.

Observers at the time gushed about the stunning growth statistics such a policy produced. Yet realities on the ground quickly diverged from the rosy aggregates. When output was measured by weight, managers were incentivized to produce heavier products, even if it made the product useless.

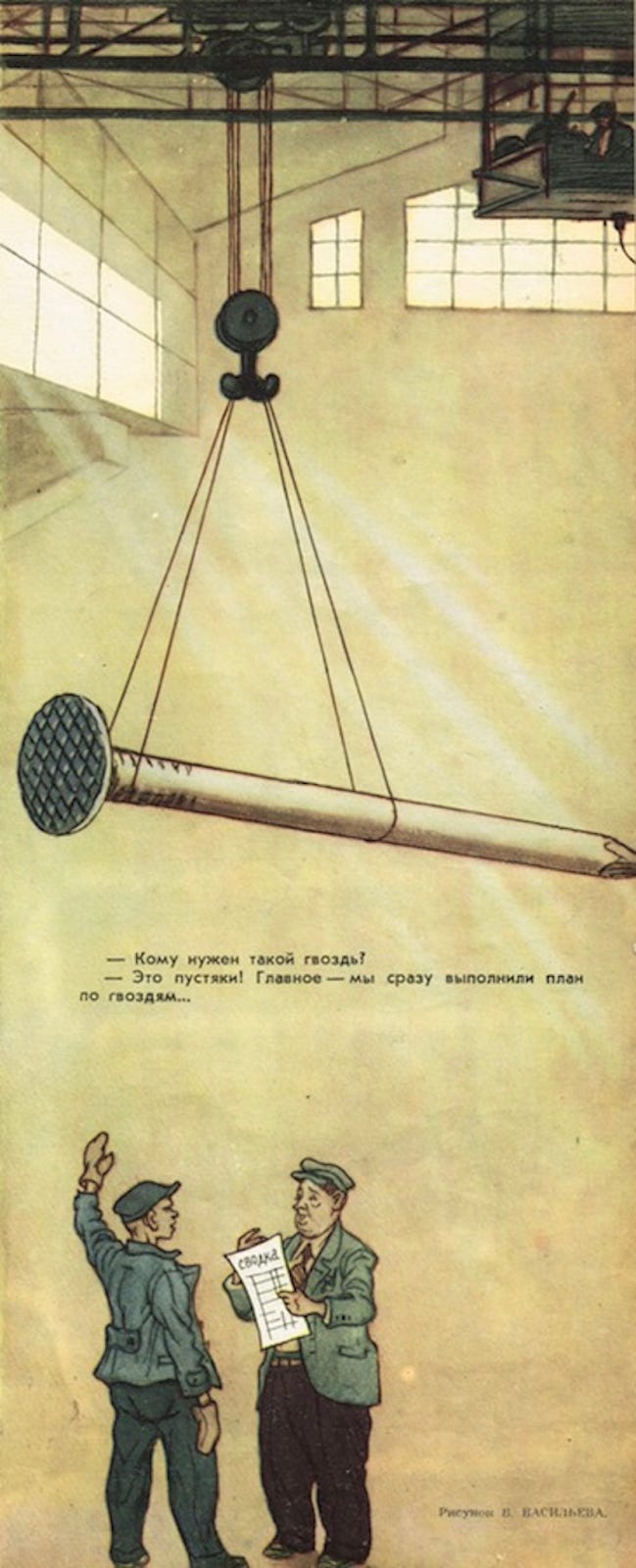

One Soviet cartoon satirized the many absurdities that such a system produced.

Worker: "Who needs a nail 10ft long?"

Bureaucrat: "That is irrelevant. What is important is that we achieved the metrics immediately.”

As with nails, so too with chandeliers. The more tons of chandeliers a Moscow factory produced, the more the factory earned. The chandeliers grew heavier and heavier. Eventually they began to pull ceilings down, killing and maiming people.

Metrics Industrial Complex

We have no centrally planned diktats enforced at gunpoint in crypto. But our own system has created outcomes just as dumb in pursuit of rosy aggregate statistics. Too much talent and capital inside crypto today has been deployed to produce 10 ft nails and heavy chandeliers.

“Who needs a set of defi protocols so complicated?”

“That is irrelevant. It’s important that we make TVL go up.”

Few protocols generate profits today. So observers rely primarily on activity metrics to judge traction.

Transactions, active addresses and TVL have emerged as our “not perfect but good enough” metrics of progress.

We have concentrated capital and labor to produce these metrics at scale. Projects that generate these metrics (and have positive first and second derivatives) are rewarded with more funding, glowing press coverage and soaring token prices.

Whether these metrics reflect “real usage” or solve an actual problem is irrelevant. Whether the metrics themselves are even “real” is often also unimportant.

Investors want to show LPs metrics that are growing. These metrics demonstrate traction, thesis validation and justify higher marks for their portcos in subsequent rounds of financing. These are the ingredients that will allow them to raise more money and charge more fees.

In turn, founders and the employees who work for them are under pressure to generate these metrics. Which head of BD wouldn’t like to report to their CEO that active addresses are up 250% m/m?

The incentives to keep playing this short-sighted game are considerable. They are particularly irresistible for tourists and the third-rate. For the projects without true product market fit, indirection, opacity and theater are powerful weapons. This is the reason why it is frequently more lucrative to work on forks and derivative projects. Launch the project, pump up the metrics, signal your tribal identity and cash out.

Spectrum

The situation is not always so black and white. I don’t want to ridicule the earnest founders, journalists and investors responding to the logic of a system out of their control. I’m avoiding listing specific team and project names on purpose.

There are of course also visionary investors and teams successfully resisting the logic of the system. I was fortunate to be an early part of one such team. But these are the exceptions that prove the rule.

In general there are three types of teams:

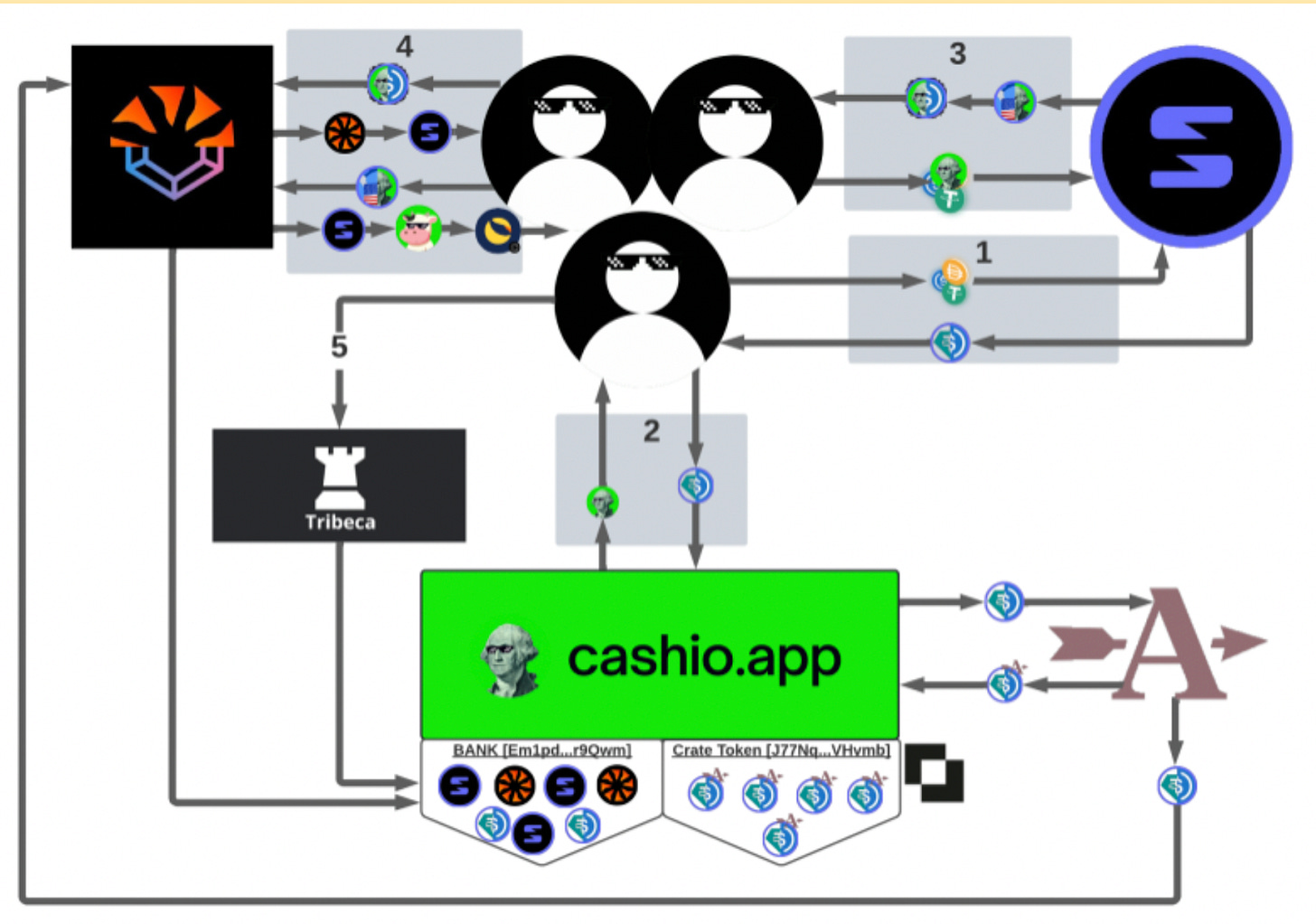

Scammers: Spin up addresses themselves, generate fake activity, rug pull

Gamers: Design the protocol to generate metrics (e.g. configure system oracle to inflate tx counts). Design airdrops and incentive programs that reward sybil behavior and generate metrics.

Angels: Actively deploys efforts to detect and eliminate sybil behavior. Internal targets are set on de-sybilled metrics.

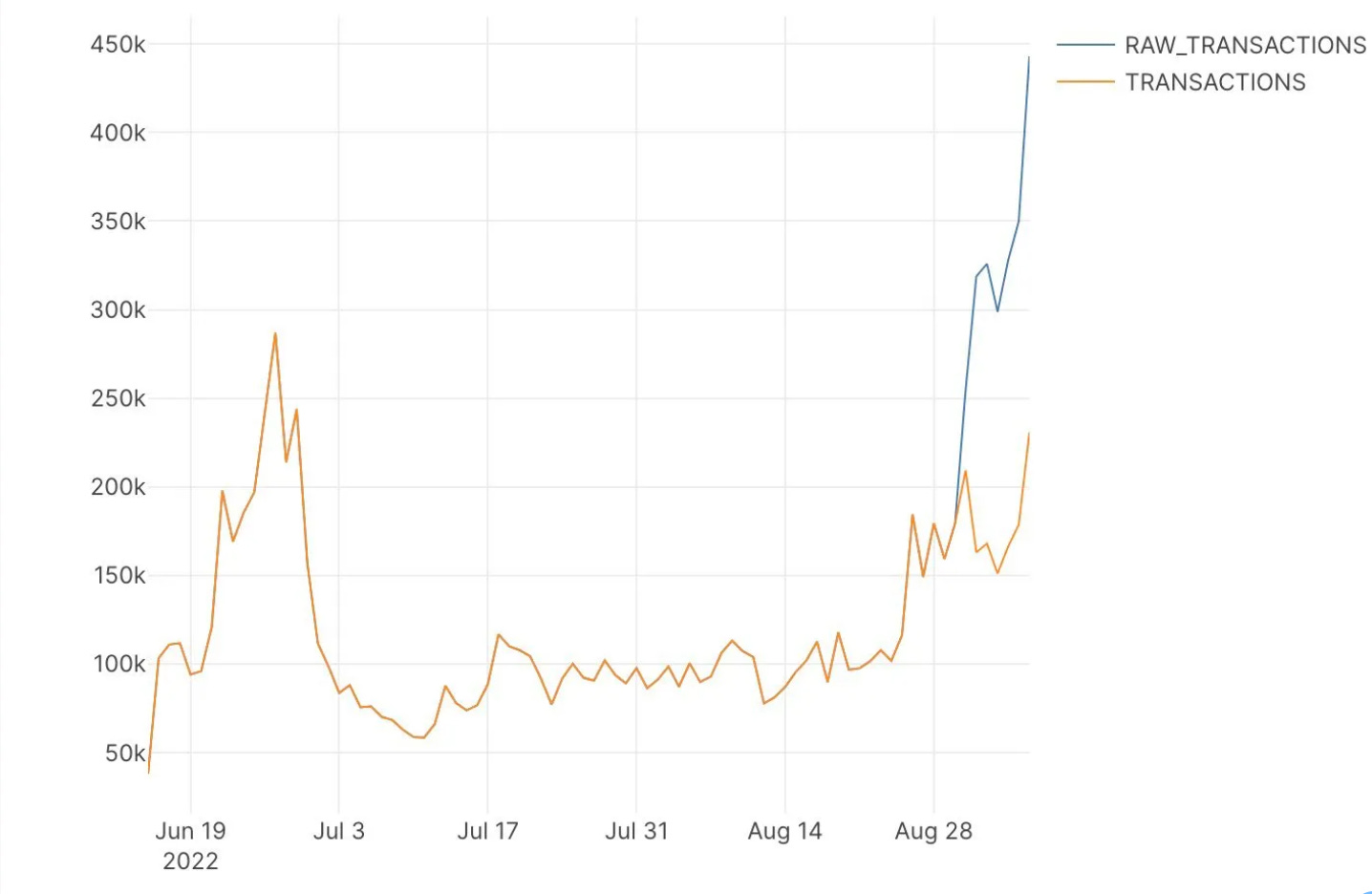

Name of protocol redacted. Transactions (in blue) appear to be skyrocketing but increase is driven entirely by changes in system oracle. Without system oracle changes, actual user transactions are actually unchanged. (in yellow)

Scaling makes the problem worse

EVM-equivalent transactions used to be expensive. So to distinguish between fake and real addresses most analysts historically used simple activity filters. To oversimplify: if the address has been transacting for months and months, it (and its activity) was “real.”

Yet there has been enormous progress in scaling since. Transactions are now orders of magnitude cheaper than they used to be. Few analysts have grasped the implications of this.

In a world where on-chain transactions are so cheap, manufacturing addresses and metrics that look “real” costs next to nothing.2

And ever since Sushiswap forced Uniswap’s hand in 2020, projects have consistently bent to community pressure and have reliably deployed retroactive airdrops. This means anybody can create 10,000 addresses that look real and claim 10,000x the airdrop tokens they are entitled to.

Few Angels

Why are there so few angels? An asymmetry has emerged. Farming these airdrops at industrial scale is extraordinarily profitable. But attempting to catch these farmers is extraordinarily unprofitable in the short term. For those with a time horizon shorter than 6 months, catching sybils is actively against their self interest.

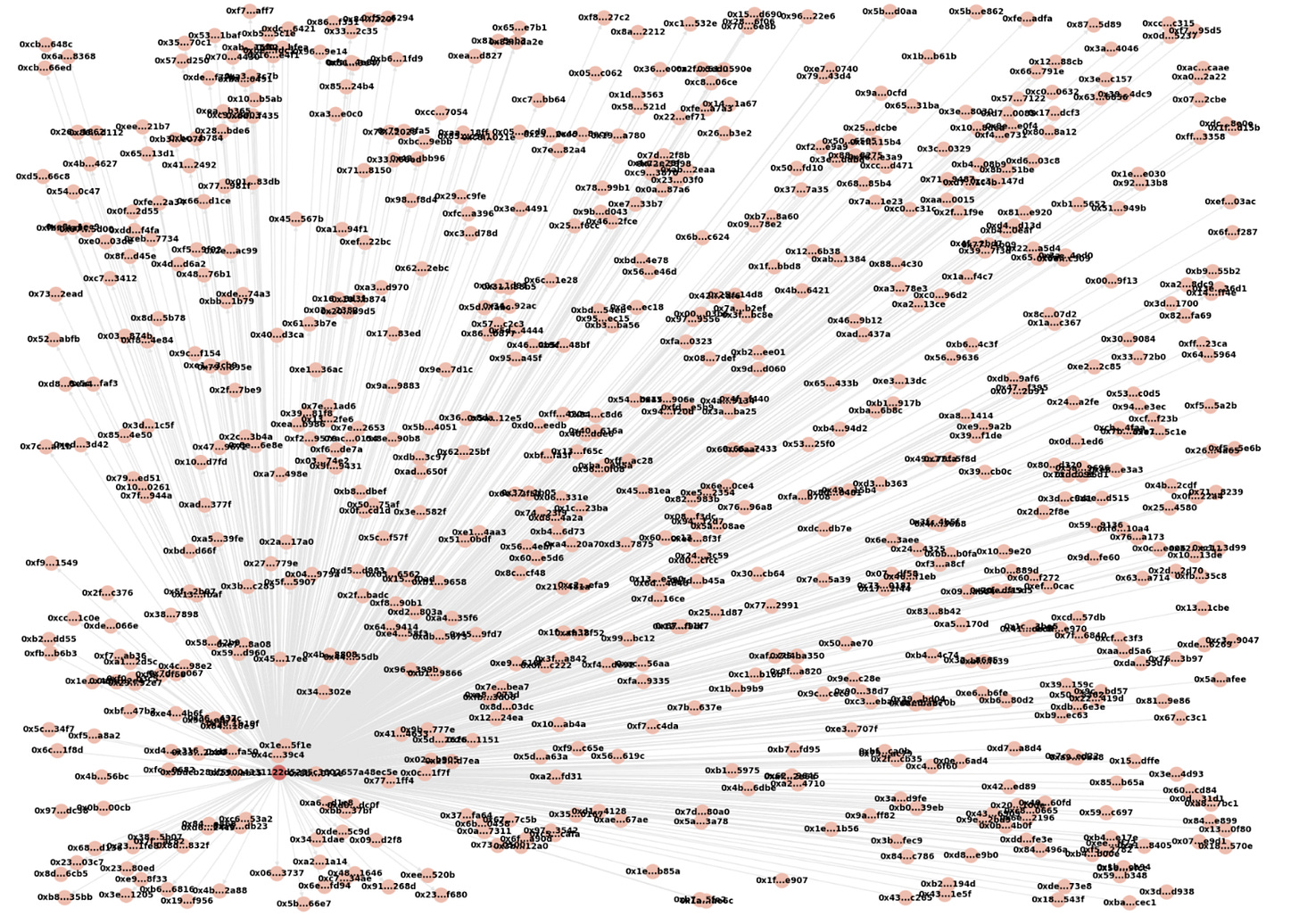

The dumbest farmers programmatically fund and create addresses that then execute identical actions on-chain in unison. The way to identify and eliminate them is to trace flows to sink and source addresses and prune the entire cluster.

0x5bDcB28Df59004331122d5235c3602657A48EC5e | Cluster Size: 685 | # Addresses removed: 678 | OP Saved: 493,154. In my (biased) view Optimism is an Angel and an industry leader on anti-Sybil efforts.

There are smarter ways to spin up an undetectable, probabilistic sybil web. In the public interest I will resist the temptation to discuss them here.

Some teams have opted for “report and get a bounty” type mechanisms. These are unlikely to work in the long term– they neglect second order effects and fall prey to the Cobra Problem.

Over in Guangzhou, there are anecdotal reports of sybil farms staffed with real people. Endlessly creating addresses, generating transactions for the sole purpose of token farming. Private Wechat and Discord channels are filled with tips on how to evade existing sybil filters.

Ultimately this is an adversarial game where the defender is at a fundamental disadvantage. If the attacker wins, he gets incredibly rich. If the defender wins, he gets to alter a .csv file so that other (presumably real) addresses get a few more tokens.

New Tools

For scammers the framing of attack and defense is itself wrong. These projects are simply not interested in defending in the first place. And why should they? Consider the following:

They forced a token into protocol design to create monetization (“the token is the product” )

They need to distribute the token widely anyway to demonstrate decentralization for legal purposes (this is what many discussions of airdrops as CAC miss)

The higher the numbers are right now the better

They do not care what happens 6 months from now

A more sympathetic reading is that many projects are in a prisoner's dilemma. It would be better for everybody if everybody reported “real”, “de-sybilled” metrics. But such a world requires everybody to cooperate and report truthfully. Unilateral defections are too profitable to make such an equilibrium likely.

And indeed we appear to be moving in the opposite direction. A suite of new approaches are launching that enable projects to give tokens away in exchange for on-chain actions. They have different names (Quests, Iterative Airdrops, etc) and surface level differences but the underlying logic and source of demand is the same.

Like the original airdrop, these are powerful, morally neutral tools. If used responsibly they can acquire real users, jumpstart network effects and distribute ownership democratically.3 Used irresponsibly these are merely more methods to purchase fake metrics and exit scam.

Coda

Critics that make a living as crypto skeptics will misread this article as an admission that crypto is nothing but a giant metrics game. That there is something about crypto that makes it uniquely evil, untrustworthy, fraudulent.

Let me be unequivocal: these critics are wrong.

The Metrics Industrial Complex extends far beyond and long predates crypto. The legendary author of What Works on Wall Street (1997) Jim O’ Shuagnhessy says often that “the four horsemen of investment apocalypse are fear, greed, hope and ignorance.” The rails this time may be faster, but the underlying drivers are as old as markets.

Yet we must aspire to do better than the industries that have come before us. The rapid growth a token enabled GTM can catalyze, the legitimacy a credibly neutral governance design can confer, the speed, global liquidity and constant uptime enabled by de novo rails, free of the accumulated accidents of history are historically powerful, disruptive forces. We have a responsibility to use them well.

At our best our industry has risen to the occasion. Consider the example of the young boy from Kolomna who built a protocol generating hundreds of billions of dollars of value, then voluntarily ceded virtually all of the economics and all of the formal powers.

Today he lives out of his backpack, with few material possessions. What is the historical precedent for this level of commitment to credible neutrality and the public good? Washington in the 18th century? Cincinnatus in 458BC? We must dare to follow his example in building a new kind of institution.

Heavy Chandeliers

When Khrushchev discovered that factories were producing chandeliers so heavy they pulled ceilings down, he exploded at a group of Soviet planners:

“Who needs [these metrics]?! To whom does it give light?!”

The Metrics Industrial Complex is corrosive to building lasting crypto institutions and products. It leads to a systematic misallocation of capital and crypto talent. It slows real progress. It advantages the grifter at the expense of the builder. It provides a strong incentive to build the useless, the unoriginal, the masturbatory, the needlessly complex, the dangerous. The heavy chandelier.

Yet precisely because the products of this system are so disappointing, its eventual reform is inevitable.

The best talent in crypto should refuse to work on heavy chandeliers. They deserve real problems, with real impact. They deserve to work on something that will give light.

Chandeliers is about the most promising paths forward for our industry

My goal is to write as infrequently as possible, on only ideas that truly matter, and only after weeks of careful thinking. Bangers only

I am not available for consulting work

Early subscribers will receive prioritized twitter dm responses @haonan

Note that the second order effect on fiat backed stablecoin depegging was also foreseeable. If your CFO did not anticipate a possible depegging, and blindly left a significant amount of your runway in USDC, it means he/she fundamentally did not understand these dynamics. The risk / reward here was way off.

This is the case for virtually any set of activity based criteria. To see this, ask yourself: how much would it cost to produce an address with 100s of txs across multiple L2s / alt L1s? And how much is the average airdrop value? What is the breakeven? How small would airdrops have to be to make farming unprofitable? Would an airdrop so small be acceptable to the community?

Interesting to see your thoughts from 2022.

I think it all makes sense, from this to Codex